Here are some of the highlights of Secure Act 2.0 as it relates to personal finances:

- Required Minimum Distribution (RMD) Starting Age Is Getting Pushed Back Again

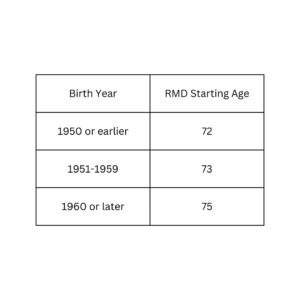

- In 2020, the Secure Act changed the starting age for RMD’s to age 72. Secure Act

2.0’s new starting age will be 75–but there’s a phase in. Here’s what it looks like:

- In 2020, the Secure Act changed the starting age for RMD’s to age 72. Secure Act

- RMD’s No Longer Required From Roth Employer Plans

- Previously there were no RMD’s for Roth IRA’s, but you still had to take RMD’s

from Roth 401k’s, Roth 403b’s, Roth 457’s, etc.

- Previously there were no RMD’s for Roth IRA’s, but you still had to take RMD’s

- New Roth SIMPLE and SEP IRA’s

- Prior to Secure 2.0, Roth options were not available in SIMPLE and SEP IRA’s.

- Employers Can Now Make Roth Contributions

- Prior to Secure 2.0, Employer matches and other contributions to employer

plans were always traditional (tax deferred) contributions regardless of the

employee’s contribution.

- Prior to Secure 2.0, Employer matches and other contributions to employer

- Roth Catch Up Contributions For Wages Over $145K

- For W–2 Employees, if you earn more than $145K the previous year and you are

making catch up contributions, they will automatically be Roth contributions.

- For W–2 Employees, if you earn more than $145K the previous year and you are

- Potential Ability to Transfer 529 Funds to Roth IRA’s

- There is a $35K lifetime limit for these transfers and several other stipulations

that must be met in order to allow this transfer to happen (529 must exist for 15

years, etc.) - These transfers can start in 2024, but make sure you look up the rules to see if

you would be allowed.

- There is a $35K lifetime limit for these transfers and several other stipulations

- IRA Catch Up Contributions Will Be Indexed For Inflation Each Year

- Starting in 2024, the catch–up contributions for those over age 50 will be indexed

for inflation in $100 increments

- Starting in 2024, the catch–up contributions for those over age 50 will be indexed

- Employer Plan Catch Up Contributions Will Increase For Ages 60–63

- Starting in 2025, those who participate in Employer Retirement Plans and who

are ages 60–63 will be able to contribute more than just the catch up

contribution.

- Starting in 2025, those who participate in Employer Retirement Plans and who

- Maximum Annual Qualified Charitable Distributions (QCDs) Will Be Indexed For

Inflation- The annual amount for a QCD has been $100K for 15 years. Starting in 2024,

QCD maximums will be indexed for inflation.

- The annual amount for a QCD has been $100K for 15 years. Starting in 2024,

- RMD Penalties Reduced

- Beginning in 2023, the penalty for not taking your RMD for the year is reduced to 25% (from 50%) AND there is a correction window so that you can correct your mistake and reduce the penalty even further to 10%.