Does the thought of a 10% stock market drop make your stomach drop?

Maybe you recall the jitters and anxiety when the last crash came through, and you watched the value of your investments fall…and fall…and keep falling.

Unfortunately, you can expect sharp drops in the stock market at any time. Today, tomorrow, next week. It can happen suddenly, and without warning.

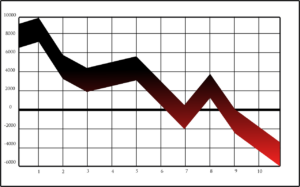

Even within recent memory, there was the dotcom boom-and-bust, and the Great Recession of 2008-2009, where the stock market lost 48% of its value from peak to trough1. Those who fared the worst were the ones who sold their stocks as the market kept falling and realized their losses.

Watching the markets ebb and flow is like being a surfer watching the waves.

Surfers don’t have the opportunity to do much when the water is smooth or barely rippling. The fun doesn’t start until the monstrous waves start crashing.

To a passerby, the waves look scary and dangerous. But to a surfer, all they see is opportunity.

Just like surfing, in the stock market opportunity comes with fluctuations in the underlying environment.

Surfers know that a big wave can mean a tremendous and awe-inspiring ride, but it can also mean a big wipeout.

In the stock market, there are typically three reactions, as there are to any kind of potential bad news: fight, flight, or freeze. Sometimes doing nothing (or freezing) is the right thing to do.

Of course, the trick is knowing which one is best for your personal situation! Unfortunately, it’s all too easy to take the wrong lessons from the past recessions and market pullbacks, leaving you unprepared for a big wave when the next one hits. Knowing how to take those rides through the rough and smooth will help you not only potentially build more wealth, but potentially lose less when the inevitable dips, recessions and pullbacks occur.

Just as waves are crucial to surfing, volatility is a feature of the market, not a bug.

Given that no one knows when the next drawdown could occur, are you confident that you’ll be able to ride it out without losing your money…or your mind?

Here are some tips for surfing the waves of market volatility:

- Technique #1: Know when to hang on so you don’t drown

- Your investment losses are only on paper…unless you actually sell. Staying invested and riding out the fluctuations is often the right way to handle volatility in the market. You should have an emergency fund in cash to dip into to avoid tapping into your investments when they are down.

- Technique #2: Know how to balance your risk tolerance

- Risk is the flip side of reward. By overprotecting your portfolio from volatility, you won’t have enough purchasing power later on in life. While Americans spent a few years not experiencing much inflation, 2021 brought a sudden 6.2% uptick in prices—that was the highest spike in decades2. You need some exposure to the stock market throughout your lifetime in order to help maintain your purchasing power.

- Technique #3: Know when to skip the surf

- As you approach your withdrawal date, you’ll need some funds that won’t be subject to a stock market pull back. Having a cash flow strategy in place for your retirement is important .

No one has a crystal ball to spot the next crash coming. Since stock markets have been swelling pretty consistently since 2009, the next trough is likely not far away.

Sources:

1-https://www.atlantafed.org/cenfis/publications/notesfromthevault/0909

2-https://www.pewresearch.org/fact-tank/2021/11/24/inflation-has-risen-around-the-world-but-the-u-s-has-seen-one-of-the-biggest-increases/

Financial Journey LLC is a registered investment advisor offering advisory services in the state of Virginia and in other jurisdictions where exempted. Information provided is for educational purposes only and not, in any way, to be considered investment or tax advice.

No comment yet, add your voice below!